IMPORTANT TAX DOCUMENTS & DEADLINES

The due date for filing your tax return is April 15th, 2024, if you’re a calendar year filer. The last day to do taxes isn’t the only important tax deadline to be aware of. There are other important tax deadlines you should know for 2024 and when your tax forms may be available to you.

***Most 1099 tax forms for tax year 2023 should be available online for IEM clients between January 20th and February 10th, 2024, and should be mailed shortly thereafter. Please see the 1099 Forms Cycle section below for more information as tax season approaches.

-

If you are self-employed or have other fourth-quarter income that requires you to pay quarterly estimated taxes, the payment must be postmarked by January 15th, 2024 or the next business day if January 15th is a Saturday, Sunday, or holiday.

***Please keep in mind January 15th falls on MLK Day in 2024 - so the due date is January 16th, 2024.

-

To ensure you're able to complete your tax return on time, the IRS requires all employers to send you a W-2 no later than January 31st following the close of the tax year. Generally, this means W-2s get sent by January 31st, but you won't necessarily receive your form by this date.

-

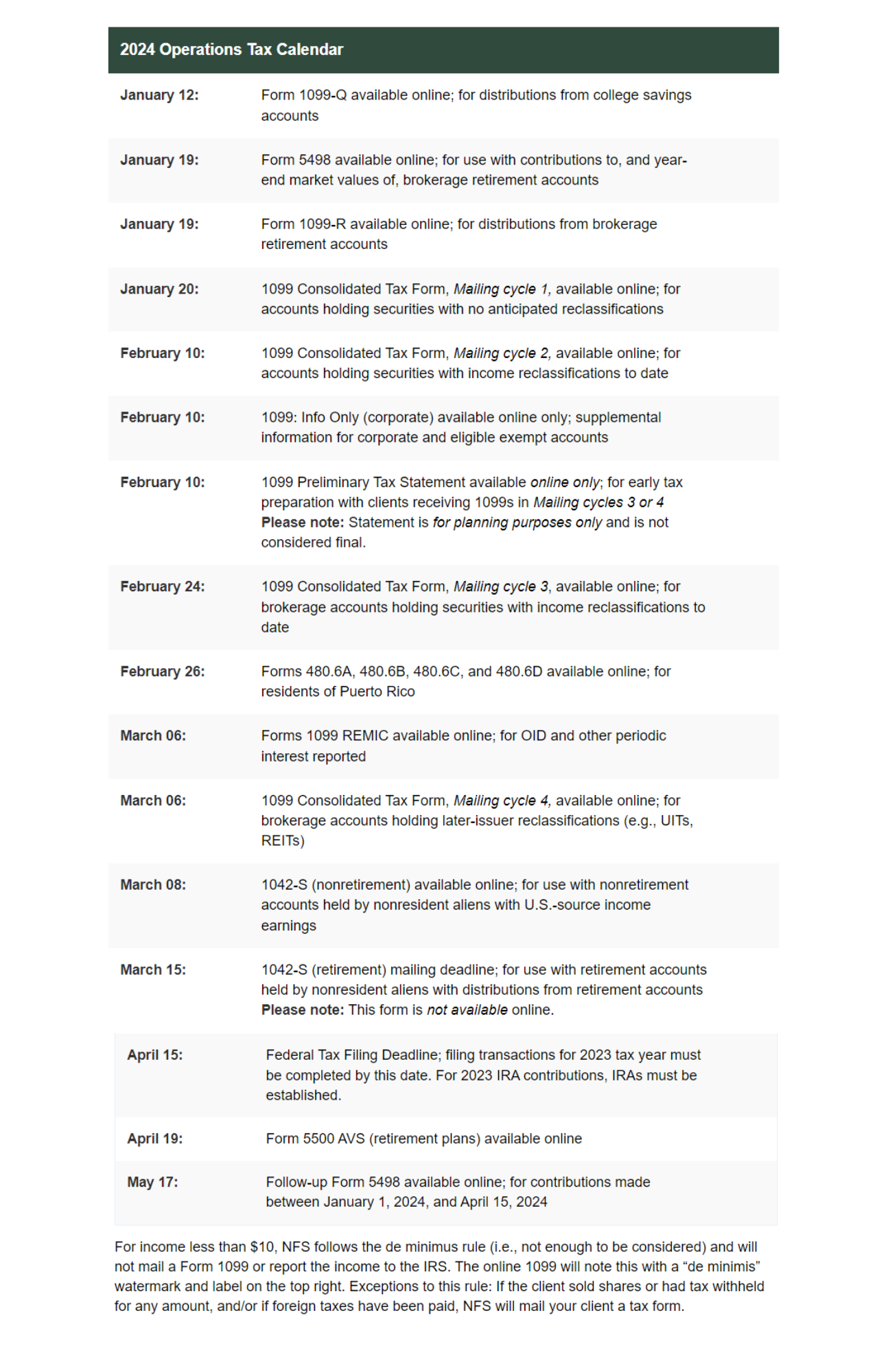

***January 20th, 2024 - 1099 Consolidated Tax Form, Mailing Cycle 1 - available online; for accounts holding securities with no anticipated reclassifications.

***February 10th, 2024 - 1099 Consolidated Tax Form, Mailing Cycle 2 - available online; for accounts holding securities with income reclassifications to date.

***February 24th, 2024 - 1099 Consolidated Tax Form, Mailing Cycle 3 - available online; for brokerage accounts holding securities with income reclassifications to date.

***March 6th, 2024 - 1099 Consolidated Tax Form, Mailing Cycle 4 - available online; for brokerage accounts holding later-issuer reclassifications (e.g., UITs, REITs)

Be on the lookout for these 1099 forms; 1099-NEC, 1099-MISC, 1099-Q, 1099-R and 1099-K if applicable to you. Please see below for additional information on various forms:

***1099-R forms are sent when distributions are made from a retirement plan. In addition, QCD's are not tracked separately on the 1099; you'll need this information for your tax preparer. In addition, "Back Door Roth" contributions will also appear on the 1099 form; please be sure to let your tax preparer know you aren't inadvertently taxed twice.

***1099-Q forms are for distributions made from a 529 plan. Please keep this form with documentation for any expenses.

***5498 forms are informational only, but are used in certain circumstances - such as when an IRA distribution combines both pre- and post-tax funds.

-

If you chose to claim an exemption from your employer by withholding taxes from your paycheck last year utilizing a Form W-4, you'll need to re-file the form by this date. You would file this exemption request if you anticipate having no tax liability this year and had none in the previous year.

-

The tax deadline typically falls on April 15th each year but can be delayed if it falls on a weekend or holiday.

-

The Tax Day deadline is also the last day to file Form 4868 requesting an extension to file your individual income tax return. If you won't be ready to file your tax return by tax day, make sure you instead complete an extension request, granting you the ability to delay filing a completed return until October 15th, 2024.

But remember, even if you choose to file an extension, you are still required to pay any taxes you may owe by the April deadline.

-

For individual income tax return filers, this also marks the final day to make contributions to your IRA or HSA for the 2023 tax year. After this date, you generally can't make contributions for the previous tax year.

-

Making estimated tax payments means that you need to estimate how much income you're likely to make for the year and determine how much you will owe to the IRS for income taxes.

***June 17th, September 16th, and January 15th (2025) are the other 2024 quarterly estimated tax due dates.

1099 FORMS CHART SCHEDULE FOR 2024

IRS CONTRIBUTION LIMITS FOR 2024

For 2024, the IRS updated its indexed dollar limits for qualified retirement plans compared to last year. This update is for informational purposes and is not intended as legal advice. Please see below for changes to dollar limits for various plans:

-

The contribution limits have increased from $6,500 ($7,500 for ages 50+ year old) to $7,000 ($8,000 for ages 50+ years old) from the previous year.

-

The contribution limits have increased from $22,500 ($30,000 for ages 50+ years old) to $23,000 ($30,500 for ages 50+ years old) from the previous year.

-

The contribution limits have increased from $22,500 to $23,000 from the previous year.

-

The contribution limit for those under 50 years old is $23,000. For those over 50 years old, their catch-up contribution is 30,500 which includes the $7500 limit for 2024.

-

The contribution limits have increased from $265,000 to $275,000 from the previous year.

-

The contribution limits have increased from $330,000 to $345,000 from the previous year.

-

The contribution limits have increased from $150,000 to $155,000 from the previous year.

-

The contribution limits have increased from $215,000 to $220,000 from the previous year.

-

The contribution limits have increased from $160,200 to $168,600 from the previous year.

TURBOTAX® / H&R BLOCK® / QUICKEN

FILING INTEGRATION WITH INVESTOR360°®

If you're a user of either the web-based or desktop version of TurboTax, H&R Block, or Quicken, you can now import your tax information from lnvestor360°. With just a few short steps, all the key tax data you need is safely, accurately, and easily transferred directly into your electronic return. With lnvestor360° and tax software integration, you can do away with:

The need to gather together a year's worth of statements.

The task of keying in data from multiple sources.

The worry associated with either missing or incorrectly transcribing important tax information.

Click the images below for a PDF document link to learn more.

TAX FORM INTEGRATION WITH INVESTOR360°®

Accessing your tax documents through Commonwealth Financial Network’s® Investor360°® portal has never been easier. We’ve provided a reminder tutorial video on how to use the Investor360°® client portal and a tutorial video on how to access your tax documents for reporting season.